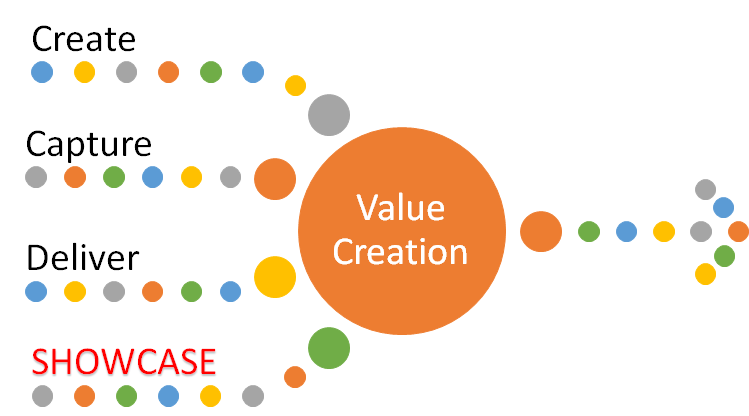

Definition of internal audit , IIA standards, professional organizations preaches internal audit to add value. Internal auditors claim that they always add value.

Still organization demand value from internal auditors.

What is that internal auditors are not doing to show organisation value added by them?

is it a simple case of not measuring and not communicating the value added by internal audit or it is a case of expectation mismatch?

When recommendations of internal audit have impacts in future periods; or inputs from internal audit is taken to put controls in processes; will internal audit be still considered to have added value in current/ subsequent period?. Some of the examples where benefits would be accruing in future periods are given below:

- Prevention of future penalties by implementation of compliance report.

- Prevention of fixed assets misuse/ theft due to physical verification of assets.

- Time savings due to implementation of a new process.

- Savings in costs due to price comparison/ consolidating purchases across fewer vendors.

- Identification of revenue leakages.

- reduction in errors due to streamlining of processes.

Reference

Links to few articles in Internal Auditor magazine/ IIA survey:

- How Do I … Deliver Audit Value?

- The ABCs of Adding Value

- Call to Action: Internal Audit Must Add Value

Call for action:

Inputs/ comments/ suggestion: I welcome inputs/ comments / suggestions from readers on how to approach this issue. Feel free to correct me, educate me.

Share the Article: If you like it, share it. If you share it with others, and they comment, we all will get more learned.

(Disclaimer: The views expressed constitute the opinion of the author and the author alone; they do not represent the views and opinions of the author ’s employers, supervisors, nor do they represent the view of organizations, businesses or institutions the author is, or has been a part of.)